Home Equity Line of Credit in Canada Made Flexible

Access Funds When You Need Them

A home equity line of credit in Canada lets you borrow as needed, using your home’s equity as security. Unlike a lump sum loan, a HELOC gives you flexible, revolving access in which you pay interest only on what you use and can draw funds anytime within your approved limit.

Mortgages365 guides you through the process with practical advice, lender-matched solutions, and repayment options that fit your lifestyle.

- Personalized equity review to calculate borrowing power.

- Interest-only or flexible payment options.

- Trusted Canadian lenders offering competitive HELOC terms.

- Full guidance on setup, limits, and repayment flexibility.

- Clear comparison to refinancing or equity take-out solutions.

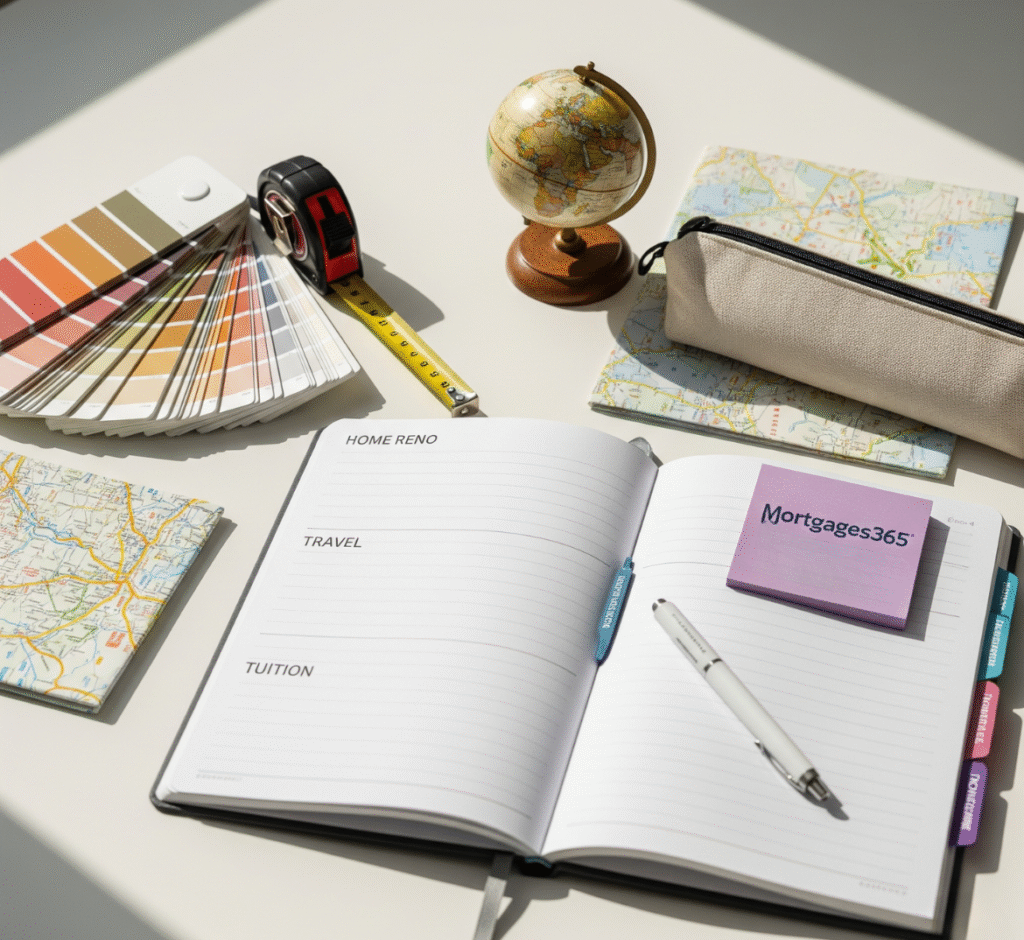

Flexible Use for Real-Life Goals

A HELOC works best when your plans need both structure and flexibility. We help you use your equity to fund meaningful moments without losing access or control.

- Home Improvements: Upgrade your space on your schedule with on-demand funding.

- Tuition or Travel: Pay as you go for education or family plans.

- Emergency Access: Maintain a safety buffer without dipping into savings.

We build a strategy around your goals, whether personal, practical, or long-term.

What You Can Expect from Mortgages365

Equity Evaluation

We start with a review of your property’s current market value and outstanding mortgage balance to determine how much credit is available.

Tailored Credit Structure

You can choose a setup that suits your preferences—interest-only payments, gradual drawdowns, or flexible repayment terms.

Lender Matching

Our network includes major banks and specialty lenders, giving you access to HELOC options that match your income, timeline, and equity.

Clear Terms and Costs

We explain all aspects of the HELOC, including interest rates, minimum draws, closing costs, and how it compares to other lending tools.

Proper Planning

We walk you through your options, not just your application. You’ll always know what to expect, even if you’re not ready to borrow immediately.

Ongoing Support

From setup to withdrawal, we’re available to answer questions, suggest changes, or guide you through lender updates along the way.